This is one of the most popular trader’s strategies to manage opened trades. The reason of the popularity of this strategy has to do with the psychological aspect; risk aversion is inherent to human being and therefore it is too tempting finding oneself in a scenario where losses are removed from the resultset. However, does it improve our system expected value? Which phenomenon creates the deception of doing well? In order to answer these questions, let’s see an analysis over a real system.

Impact over EV

This system has fixed both stop loss and take profit in a 1:8.5 relation. The graph below shows the impact over the EV as a result of moving the stop loss to break even after the price has reached different fractions of the take profit. For instance, a value 0.9 in the horizontal axis means that the stop loss is moved to break even after price has reached 90% of the take profit, and its corresponding vertical axis value (∼0.99) means that the system EV slightly decreases about 1%. Data are normalized to the baseline, which is the system not leveraging this strategy. Hence, values of EV lower than 1.0 are not desired. This graph shows a clear trend: the sooner the stop loss is moved to break even the more the system performance worsens.

If we are awared of price volatility, at a first glance we might be tempted to think that this profit protection technique will improve our trading if we are able to find a suitable point to apply it, but the reality is that this point does not exist. Notice that even when price has almost reached our profit target, and therefore the stop loss is far from price, this strategy also fails to improve the system performance.

“Break even is just related to risk aversion, not to price behaviour”

Overestimating hit rate

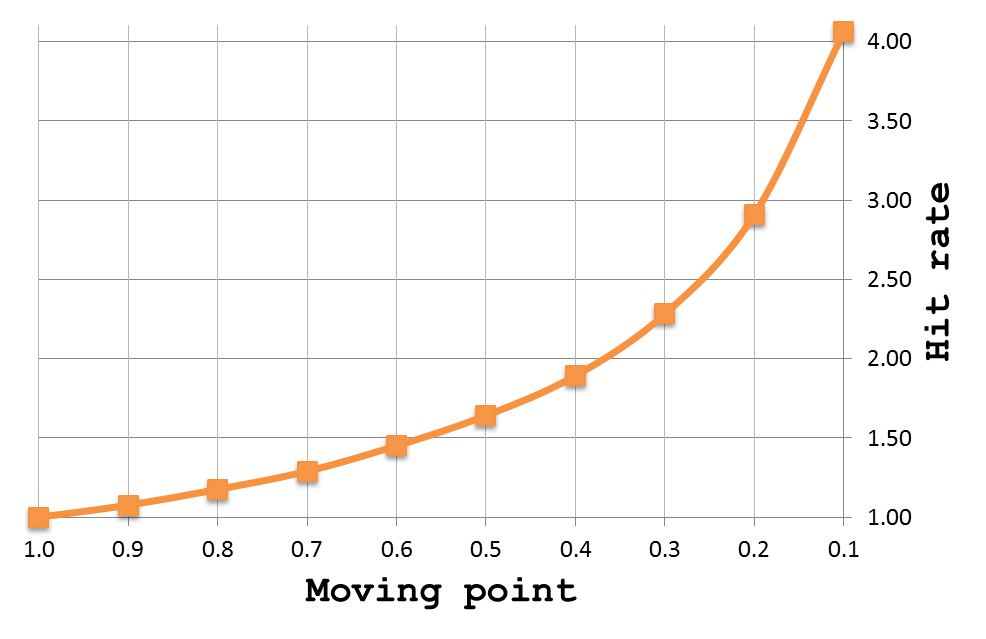

Another aspect of psychology that runs counter maximizing expected value is giving too relevance to the qualitative outcome while underestimating the quantitative one. In this sense, many traders usually prefer systems with high hit rates, downplaying EV. Moving stop loss to break even has the effect of increasing the hit rate, and hitting more often causes the deception of doing better. Moreover, this is specially harmful since the sooner we move the stop loss the more the hit rate increases. Note that for the evaluated system, moving the stop loss when the price has reached 10% of the target makes our system to hit four times more!

Finally, I would like to raise some questions about the fundamentals: where should i place a stop loss? Is break even point relevant? Does break even point invalidate our trading after our trade has partially succeed, instead of our initial stop loss? How should i be concerned about volatility? Try to answer these questions and you will probably conclude that break even has no relevance from the point of view of price behaviour. I encourage any trader who read this article to backtest this strategy to check out the impact over its profit.